How Much Does A Startup Founder Earn In A Year?

Zero To €100k Revenue In 12 Months — Month 6

What is the least amount of money you would need to survive for 12 months? Take 10 seconds to get that figure in your head. Got it? Now read on.

By now, I am 6 months into my startup journey and for the first month since I started, I am able to pay myself a wage! Time to crack out the Aldi Sparkling Wine.

How much did I pay myself? €500 to start with, rising to €1,000 per month after a few more months.

The minimum wage in Ireland in 2017 was €9.25 per hour. In April, I was doing an average of 10–12 hours per day.

7 days per week, Monday- Saturday, averaging 10–12 hours per day and maybe 5 on a Sunday.

Simple math tells us that my hours worked per week would be 71 (taking average of 11). Divide that by the €1,000 wage per month and it leaves us with an hourly wage of €3.52.

Could you survive on €3.52 per hour?

The answer to that question will immediately be no! Of course it will. Not all entrepreneurs will go this road. But if you can answer yes to that question, because you believe in yourself or your idea so much, then you might have the determination to make it happen.

The figures above are not an attempt to brag, discourage you or show how hard I can work. They are simply to highlight the grind of it and the absolute crazy level of work its takes when you are a solo entrepreneur.

The entire reason for me writing this series was to record my journey for personal reasons but also to help future versions of myself from making the same mistakes.

Not every startup will have the same experience, some will be profitable after a month, some will never make a profit. Always remember there is no absolute set of rules to follow and always use other people’s story a guide, not a blueprint to follow.

Why I worked for €3.52 (And why I’ll do it again)

Freedom. Freedom to decide my day, week, and future.

Being an entrepreneur should be a long-term view. For me, its about building multiple revenue streams that allow me to pursue areas that I am interested in.

I love the lifestyle and I am disciplined enough to work hard when required. It is 100% not for everybody so think if you have the self awareness required to be honest with yourself.

Track Everything

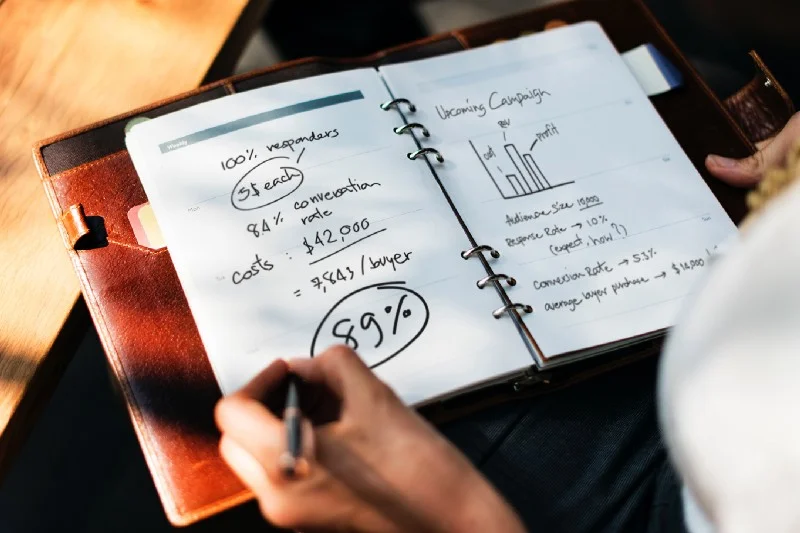

The only way you will survive year 1 is to track every cent of income coming in and out of your business. This will tell you if you can pay yourself and how much.

If you don’t keep an eye on costs, you are sunk. No exceptions.

I designed a very simple profit and loss spreadsheet that I would update at the end of every week and month. This allowed me to spot patterns and trends within the business.

It showed me what was performing well and most importantly, what wasn’t.

Next week, I will reveal the exact tools and strategies I used to track revenue and most importantly pivot my product offering to make the most profit.

Most startups die by suicide not murder — Paul Graham

How to survive on €12/$12k per year

There is no magical reason why I picked €1k per month. It was simply chosen as it was the amount I felt the business could sustain to pay me while still growing. If you feel you can pay yourself more, go for it.

The temptation for a lot of entrepreneurs is to start splashing the cash after a year or two of living very frugally. Just make sure if that unexpected happens, (it will), such as a crazy tax bill arrives, that you suddenly aren’t left penniless.

Survival Tactics

There is no magic bullet strategy to survive year one in business but the following steps helped me plan. Plan that you will have zero revenue for year 1. Be prepared for the worst-case scenario. If you run out of money 6 month into your adventure, all your hard work will be for nothing.

Save 1 year’s personal income to allow you to live very frugally. Be realistic. Calculate your rent/mortgage, food, travel, social life.

Cut all unnecessary outgoings. You can’t live like a monk but you will need to cut back. Booze, cigarettes, holidays. Whatever you vice is, consider cutting back or kicking it out.

Create an emergency fund. Put aside a portion of money to cover something very unexpected happening. You car breaks down and you need to get a replacement or a customer doesn’t pay a bill for 90 days instead of 30 days. Don’t let something relatively small derail your entire future through a lack of planning.

“If you will live like no one else, later you can live like no one else.” — Dave Ramsey

Simple translation, put in the hard yards now so that you can elevate yourself beyond everyone else later. Discipline now, freedom later.

Six Month Task List

Do a check-in with your accountant. Identifying any finance issues now will save you weeks of work when it comes to filing your end of year returns. Not fun but essential. Don’t skip this part.

Take a half-day away from the office to pause, reflect and analyse your performance for the previous six months. As an entrepreneur, you have no boss or colleagues to give you feedback so its incredibly important to be self-aware. Noah Kagan has a great YouTube video on this process.

If finances allow, hire someone to assist you part-time. By now your business should be keeping you busier than a normal workday allows you to cover. I wish I had hired someone at this point as I was running myself into the ground with 18 hour days.

Cut anything that is not making you money. This can be products or services that are not performing or you are selling for too low a cost. Raise the prices or cut the product. Be ruthless. Next week, we cover how to conduct this process.

Next Week

Next week, we are in month 7 and I make the single biggest business decision that catapulted my business towards the €100k revenue in year 1.

This is part 7 of a 12 article series telling the story of how I went from zero revenue to €100k in a year.

You can go back and read the Month 0 to Month 5 here.